Guide to Buying Real Estate in Colombia

& Getting a Colombian Investor Visa

We are often asked what is needed for foreigners buying real estate in Colombia. All you need is a passport, your cash in place, and a bit of patience. The process is really quite different than what North Americans are used to. One of the great things about foreigners buying Colombia real estate is that it can qualify you for a Colombian residency visa too. (See below for more details on the Colombia Investor Visa.)

There are a couple important points to remember when buying real estate in Colombia as a foreigner. The Colombian marketplace is not over-leveraged. Deals are done in cash and there is no substantial discount for paying in cash, if any. In most real estate transactions, you will see between a 3% to 8% discount in the negotiation. If you are looking for repossessions, in many cases these deals are controlled by a small group of people and, while not impossible to obtain, are very difficult to cut into this circle.

Another point that you should erase from your North American experience is the notion that if a property has been on the market for two years, you can negotiate hard and get a good deal. A Colombian will sit on a property, unless there is a really urgent need to sell, until they get what they believe it is worth. In fact, as the prices rise in the marketplace, sellers will continue to raise their own price. This is completely illogical to most foreigners, as it seems “obvious” that if they wanted to sell they would lower the price. This is a cultural view in Colombia and not something you will change.

A final note on negotiating: If you find a unit that you like but intend to rehab, do not try the tactic of saying, “Well, we have to change out all of the bathrooms and open up the kitchen, so you will need to lower your price.” Forget that! The seller will think, “I am living here and, while things might be a tad older, there is nothing wrong with the place.”

The process for buying real estate in Colombia consists of a verbal offer, the price on the deed, the amount of the deposit, how the road improvement tax will be paid (this applies to Medellin), when the Promesa de Compraventa will be signed, the deposit, and the date for the closing.

There are two very important points that you need to note. In Colombia, there is NO title insurance and NO escrow. At this step you need to hire an experienced lawyer who understands real estate law to do a title search and a series of other background checks. This is of utmost importance!

Once the title search is done, the lawyer will prepare the document called the Promesa de Compraventa. This will outline all of the details above. It also includes a penalty clause, often of 20%, that is applied for default to either party. This is a very serious matter, and Colombians are not likely to default. You, as a buyer, must now pony up the deposit that goes directly to the seller.

The final step for buying real estate in Colombia as a foreigner is the signing of the deed (escitura). At this point you will finalize all of the paperwork, make the remaining payment, and receive the keys.

Foreigners without a Colombian ID generally can not obtain bank accounts. Usually banks take a higher cut on the handling of funds entering Colombia, so we recommend opening a brokerage account. When the time comes, we can make the proper introductions to do this. Only a select group of companies are permitted to do this, and bringing funds into Colombia is strictly monitored.

You can bring up to $10,000 USD in cash into the country without any issue. Some people will travel with a group of friends and ask them to carry cash as well. Frankly, this is a foolish idea. Opening the brokerage account can be a bit tedious, as the Colombian government is very strict and asks a lot of questions, but this is the safest and most secure way to bring money in and eventually take it out. Every time you move money in or out of the country, it must be registered. This registration is sent to the Bank of the Republic.

As long as you have not been in the country for more than 6 months in one calendar year, you can register funds coming into Colombia as a foreign investment. This is important, especially if you are looking to apply for a Colombian residency visa based on a foreigner buying real estate in Colombia, and must be supported by the registration held by the Bank of the Republic.

Do not send the money for your purchase directly to a friend, a girlfriend, a lawyer, or even a seller. It is true that some people do this, but it is a recipe for disaster. Almost certainly, the registration will not be done properly and a worse-case scenario is that you will lose your money.

Foreigners Buying Real Estate in Colombia for a Colombian Residency Visa

The Colombian residency visa based on real estate investments (Colombia Investor Visa) use the yearly minimum wage as part of the calculations. For example, in 2016, the approximate wage (rounded up for ease) is 700,000 COP. To apply for a one-year, Special Temporary Visa, you need to make an real estate investment of 350 x 700 – or approximately 245,000,000 COP. This Colombian residency visa is renewable up to five years.

If you purchase a property of 650 times the “salario minimo” – or approximately 455,000,000 COP, you can apply for the 5-year Colombian Resident Visa. Recently, there have been changes with this visa. Technically, it has become an “indefinite” visa – every 5 years it must be “restamped.” After 5 years you can apply for citizenship.

There are two other important points that you must note in regards to Colombian residency visas. The above amounts must be registered on the deed. In most cases a Colombian will want to register a lower sale price on the deed, and this is why you must pay close attention to this in your negotiations if you intend to apply for a visa based on your purchase.

The other detail you must keep in mind is that you need to register the property in your name. It can not be purchased through an L.L.C, S.A.S., Panama S.A., or a foreign trust if you want to apply for a visa based on a property purchase.

Corporations and LLC’s to Use for Foreigners Buying Real Estate in Colombia

That being said, you can still purchase real estate in Colombia through any of these vehicles – L.L.C., Panama S.A., a foreign trust, or S.A.S. (Colombia corporate structure). If for tax purposes, or for reasons of privacy, you wish to manage your affairs in this manner, this is completely legal in Colombia. You will have to supply all foreign corporate documents, duly translated by an approved translator and legalized (probably with the Apostille seal).

If you are just interested in making a simple investment in Colombia, then buying real estate in Colombia in your own name is the best way to move forward. If you intend to buy a few properties to rent out, then you might wish to incorporate a company to manage this business. Again, a Colombian residency visa can only be applied for with property purchased in your name.

Hiring a good lawyer is the most important steps for foreigners buying real estate in Colombia. Remember, there is no Title Insurance or Escrow. Many Colombian lawyers have a vague idea of real estate law, but few hold this process to the rigorous standards that are necessary. We have very good Colombia real estate lawyers to assist you. Please contact one of the Colombia real estate agents below.

Medellin Colombia real estate agent – Juan Pablo Montoya Kallewaard is an experienced real estate agent in Medellin, specializing in the Medellin Colombia real estate market. Juan Pablo specializes as a Medellin Colombia buyer’s agent. Contact Juan Pablo.

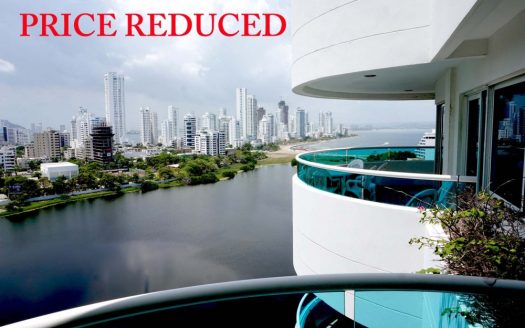

Cartagena Colombia real estate agent – Jim Main is a professional international real estate expert, whose experience spans five different nations, Jim brings his unique expatiate and international insight to the Cartagena real estate market. Jim also provides management of Cartagena commercial real estate and rental property. Contact Jim.