I recently visited my grandfather’s house, where he was born, in Wattenscheid, Germany in 1909. It was a dreary place with boarded up buildings in the heart of Germany’s industrial zone, “das Ruhrgebeit.”

As a small child I can remember my grandfather saying that “Wattenscheid,” when translated into English meant “what a sh*t.” I always thought he was joking, but I suppose all jokes have a hint of reality in them somewhere.

My two sons wondered out loud why we went out of our way to track down such a sad place. I didn’t have a great answer for them. Nostalgia and reminiscing about my grandfather and where our family came from was certainly part of it, but after being there for even an hour, my overriding thought was primarily simple gratitude.

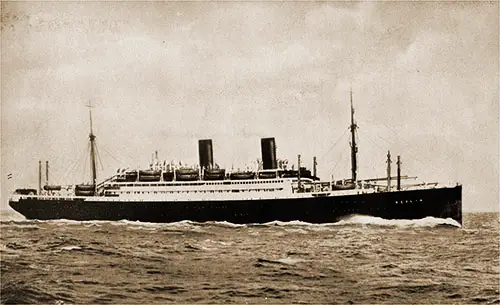

Gratitude that my grandfather, at the age of 17, left Germany and his mother and father and brothers and sisters to board the SS Berlin out of Hamburg on New Year’s Day 1927 and sail away to the United States. My grandfather never saw his father again and wouldn’t see his mother again for almost 40 years.

It took a lot of courage to get on that boat back then and head off to the other side of the world. He had no idea what to expect, other than hopefully a better life. Once he got to the States, as an uneducated immigrant, he worked in mines, steel mills, a brewery, and in a country club as a stable master tending to the horses of the “wealthy.” Most people would call them “menial jobs” but what he was really building with those jobs was a future for his seven children and an even better future for his grandchildren, which includes me.

Two generations later, I live and move in the class of people my grandfather spent his life serving. In fact, my son recently joined the country club where he tended horses nearly 100 years ago. That was only possible because of his sacrifice. No sacrifice I’ll ever make for my children will ever be as great as his.

Thinking nostalgically about the past also challenges me about what I’m doing right now for my children and future grandchildren and their families. Am I being a good steward of the abundant resources and opportunities that I have today? Those resources were built on the back of my grandfather and his efforts one hundred years ago so what am I doing now and what should you be doing now to protect, preserve, and pass on your wealth?

1. Deal with your assets now

First, regardless of which candidate wins the U.S. presidential election (and which party wins the House or Senate), the current exemption from individual gift and estate tax is scheduled to sunset in 2025 from its current level of just over $13.5 million ($27 million per married couple), to the Obama era level of just over $5 million. No changes in the law are necessary for this to happen. It’s already baked into the political cake.

What that means is for individuals with more than $5 million in assets, or couples with more than $10 million, you will be subjecting the delta between the current amount and the future reduced amount needlessly to a 40% estate tax. A couple with $27 million in assets will pay almost $7 million more in estate tax at their death if they take no action. Small businesses, family farms and properties that have become very valuable in expensive neighborhoods will be most affected by these changes. In most cases, your heirs will have no choice but to sell whatever assets are left to pay your final estate tax. That’s not being a good steward of your wealth.

Fortunately, the law allows you to deal with your assets before your death in a variety of ways, through outright gifting strategies or the creation of trusts, foundations, or family limited partnerships that move wealth out of your current “estate.” In all of these cases, the law in effect at the time of the transfer (i.e. the current $27 million threshold), applies to the transfers. Future changes to the law would not affect the transactions nor the tax consequences. So, the first action to take is to transfer up to your maximum gift and estate tax exemption amount to a structure designed to benefit your heirs and other beneficiaries before the amount gets slashed at the end of 2025.

2. Set up an international trust

Next, set up an international trust. This will allow you to take advantage of the current gift and estate tax exemption (as outlined above), and also provide a variety of other advantages over and above a domestic trust.

The international trust is considered to be a legal “person” from the jurisdiction where it has been created. This jurisdiction of the trust and corresponding “choice of laws” not only makes it very difficult to bring a lawsuit against a trustee or the trust assets but also a foreign trust reopens the door to investments, banks and other financial services that are presently “closed” to U.S. investors. The trust laws of many offshore jurisdictions are designed to give the trust grantor (ie creator of the trust) maximum flexibility in terms of the length of the trust, which can even be perpetual, as well as the manner of distributions (income, principal, outright distributions, life estates, etc.). This flexibility in drafting and administering international trusts as well as the combination of better “defense” and more diverse “offense” makes offshore trusts a powerful tool for growing, stewarding and ultimately dispersing wealth.

3. Get that life insurance policy

Third, consider taking out an international life insurance policy. These types of policies are generally owned by international trusts. They are one of the last tax loopholes for tax deferred growth and tax-free distributions. During your life, you can also borrow from the cash value of the policy which is not a taxable event.

Plus, international insurance policies can be denominated in alternative currencies such as British Pounds, Swiss Francs, or Euros. This is important if the dollar ceases to be the world reserve currency during the term of the policy. The investments inside the policy can also be diverse and include gold, real estate, stocks, bonds, and mutual funds and even Bitcoin. Gains in any investments inside the insurance “wrapper” including current interest income, dividends, and even capital gains all are exempt from income tax making insurance the most significant vehicle under the current tax system to steward wealth from one generation to the next.

4. Diversify your assets away from the U.S.

Next, utilize these offshore structures and strategies to truly diversify your assets. It makes no sense to go offshore with some of your wealth and then invest that money in IBM stock. You can do that easily enough already from your U.S. Schwab or Fidelity account. Instead, consider diversifying your international portfolio away from the U.S. and the U.S. dollar. Consider foreign currencies especially the natural resources currencies of Canada, Norway, and Australia, as well as the Swiss Franc. Look at real estate in places like Belize, Nicaragua, and Panama in Central America. Portugal, Austria, Switzerland, and Croatia have great opportunities in Europe and cities like Dubai and Singapore in the Middle East and Asia seem to have growth without end.

Gold (and the precious metals complex of silver, platinum, palladium, and some rare earths) are common in offshore holdings and is another long-term physical asset that is designed to protect purchasing power long term and from one generation to the next. Foreign real estate is also a common holding in an internationally diversified portfolio.

5. Invest in yourself

Finally, the most precious asset that each of us has (regardless of our net worth) is ourselves. My grandfather protected himself and his future family on New Year’s Day, 1927 by climbing on a ship and sailing away from the devastation and hopelessness that was Europe.

Today it’s much easier to have a Plan B in the form of overseas property, a second residency, and citizenship. Many countries make it easy to reclaim citizenship based on ancestry while others make the residency and citizenship path easy for new foreign investors. Not to be confused with legal “expatriation” (actually giving up one’s birth citizenship), becoming an “expat” is to essentially create an overseas toe hold, pied-à-terre, “lifeboat” or whatever you want to call a Plan B life for yourself outside the United States. How much you utilize your overseas lifestyle might depend on your age, income, work requirements, weather, culture, holidays, and ultimately taxation and the current political environment. The main thing is to have it when you need it.

Read more like this: Why Having a Plan B in Turbulent Times Is a Good Idea

I have many clients who don’t intend to legally expatiate unless something really bad really happens in the U.S., (civil war, confiscatory taxation, a Marxist political system, etc.) but they do like being part time “expats.” Ironically, being a part time “expat” is also laying the future groundwork for actual legal “expatriation,” since U.S. law requires a U.S. person to have another citizenship before they can legally expatriate or give up their U.S. citizenship. Otherwise, you’d technically be a “stateless” person which U.S. law does not allow.

Interestingly, the many countries that make it easy for foreign investors to acquire residency (and/or citizenship) through investment are also frequently great places to invest. I just helped a U.S. client obtain residency in Belize through investment ($250,000 minimum investment), by purchasing a preconstruction Marriott hotel unit. Not only will the client receive a fast-track residency card (which can eventually convert to citizenship), but they have a solid piece of real estate for both investment as well as personal use. This checks a lot of boxes for many U.S. residents looking to diversify their assets and themselves away from the U.S.

Taking any of the steps outlined above can help protect you and your family in the future whenever the storms of life such as litigation, hyperinflation, currency devaluation, excessive taxation, or political instability come around. Taking action now while the sun is shining, and all is well will effectively position you for the coming storms whatever they turn out to be. In the ancient words of the Chinese general Sun Tzu, “Defensive positioning is a matter of life and death. The road to safety, or the road to ruin. Hence under no circumstances can it be neglected.”

Take the actions necessary now to be a good steward of your assets and yourself and someday your family will thank you for your efforts as they escape whatever their “Wattenscheid” circumstance turns out to be.

———————

Joel Nagel is managing partner and founder of the law firm Nagel & Associates LLC, specializing in international corporate strategy and legal structures.

Joel Nagel