Global Roundup: Migration Battles, Travel Costs, and Expats in Flux

The latest news and trends from around the world

From shifting migration strategies to financial realities shaping travel habits, here’s what’s making headlines this week.

Dumped in Panama

In a controversial move, the U.S. has begun deporting migrants from various countries to Panama, turning the small Central American nation into a temporary holding zone for those facing removal. Over 299 migrants, including individuals from China, Iran, Afghanistan, and Turkey, were sent to Panama City in recent weeks as part of a U.S.-Panama agreement. Officials say that 171 of them have since opted for voluntary repatriation, while others remain in limbo, awaiting further decisions on their fate. The U.S. has justified the move as part of its broader effort to deter unlawful migration, but critics argue that it effectively shifts America’s immigration burden onto a nation already grappling with its own border challenges.

For expats and travelers in the region, the policy raises concerns about the wider implications for migration routes, border security, and Panama’s stability. Panama has long been a key transit country for migrants making their way north to the U.S., and this latest policy may increase tensions within the country, impacting safety and diplomatic relations. The question remains—will Panama continue to cooperate, or will this spark resistance from Latin American leaders weary of U.S. migration policies being offloaded onto their soil?

Read more like this: A Magical Life in Panama

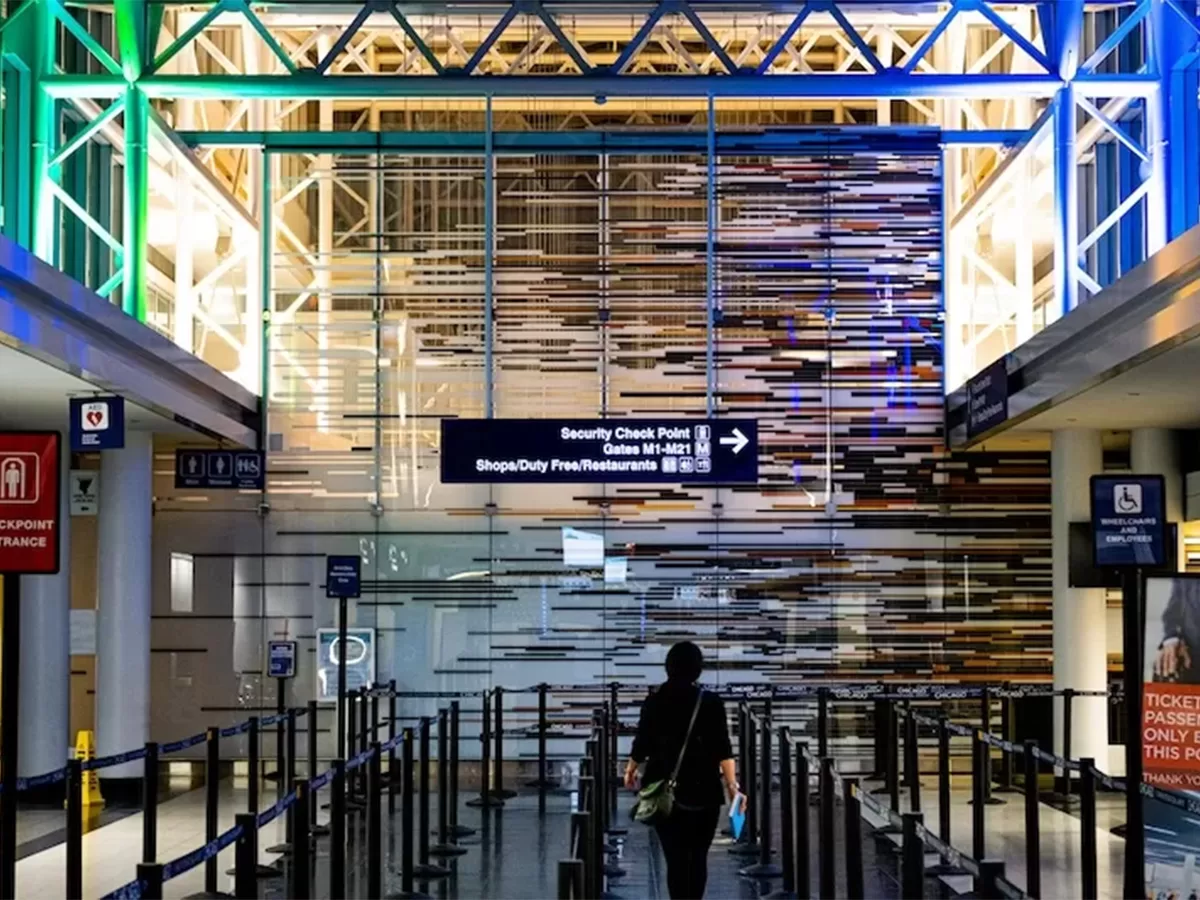

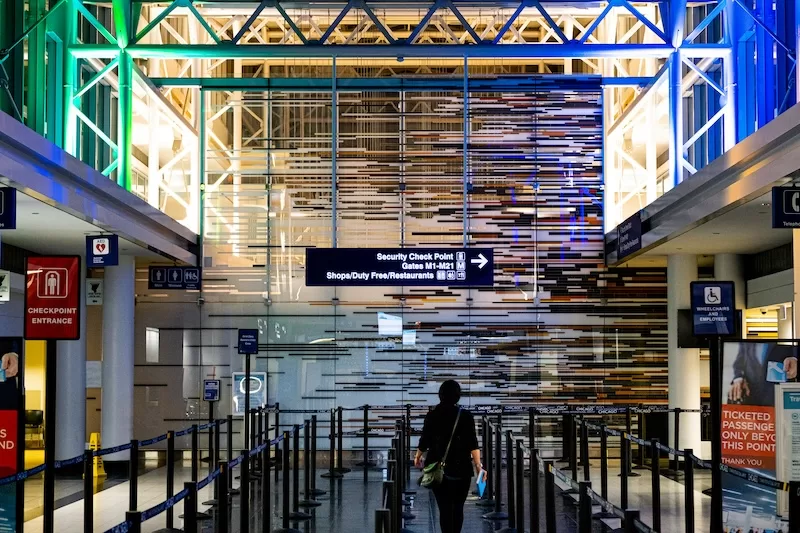

ID Countdown

The clock is ticking for U.S. travelers as the long-awaited REAL ID enforcement deadline finally looms. Beginning May 7, 2025, Americans will need a REAL ID-compliant driver’s license, a passport, or another approved form of identification to board domestic flights and access federal buildings. The requirement, which has been delayed multiple times since its original 2005 inception, is part of a federal effort to tighten security standards on state-issued IDs. While most states now offer REAL IDs, millions of Americans have yet to update their documents, leading to concerns of last-minute travel chaos as the deadline nears.

For expats and frequent travelers, the implications go beyond U.S. borders. Those returning to the U.S. for visits will need to ensure their ID meets the new standard, or risk being denied boarding for domestic connections. Additionally, some states have seen long wait times for appointments at DMVs, creating a potential bureaucratic bottleneck. With less than 15 months to go, officials are urging travelers to verify their identification now—before a last-minute scramble causes disruptions.

The Price of Freedom

A recent survey conducted by Talker Research on behalf of Travelbinger has revealed that the average American believes they would need approximately $287,731 in savings to comfortably quit their job and travel the world. This figure varies across age groups, with Gen Z respondents estimating $211,000, while Baby Boomers feel they would require around $335,000. Interestingly, about one-third of those surveyed indicated they would need over $500,000 to embark on such an adventure, whereas 18% expressed willingness to travel for less than $50,000. Notably, 17% stated that no amount of money could entice them to undertake global travel.

When asked how they would allocate a hypothetical $1 million travel budget, many Americans prioritized sharing experiences with loved ones. Top choices included taking friends and family on dream vacations, exploring historical sites, and embarking on road trips. Additionally, there was significant interest in luxury accommodations and embracing a slower travel pace to fully immerse in different cultures. However, a small percentage (4%) indicated they would return the money, citing a lack of interest in traveling

Turbulent Skies

Air travel has long been considered one of the safest forms of transportation, but a string of high-profile aviation incidents has left some travelers questioning that assumption. The latest blow came this week when a Delta Air Lines flight at Toronto Pearson International Airport crash-landed on February 17, forcing passengers to evacuate as emergency responders rushed to the scene. While no fatalities were reported, the chaos—described by witnesses as “mass panic”—has only added to growing concerns about airline safety. This follows the deadly mid-air collision over the Potomac River on January 29, where an American Airlines jet and an Army helicopter crashed, killing 67 people. With multiple accidents making headlines within weeks of each other, confidence in the industry is beginning to waver.

A new AP-NORC poll shows a decline in trust, with only 64% of U.S. adults calling air travel “very safe” or “somewhat safe,” down from 71% last year. More now view flying as unsafe, nearly doubling from 12% in 2024 to 20% today. While experts insist that these crashes are statistically rare, viral footage of emergency landings and chaotic evacuations has made travelers more anxious. The golden era of aviation safety is being put to the test.

Safe Haven

Iceland has emerged as the safest country for expatriates in 2025. A new ranking by expat insurance provider William Russell assessed countries based on healthcare access, digital security, crime rates, and vulnerability to natural disasters. Iceland took the top spot, praised for its exceptionally low crime rates, political stability, and high standard of public services. With its stunning landscapes, world-renowned quality of life, and a strong social safety net, the Nordic island remains an attractive haven for those seeking a peaceful and secure life abroad.

Read more like this: Life Abroad

Coming in second was Ireland, which scored high marks for its progressive policies, healthcare system, and safety levels, making it an ideal choice for expats looking for a European base. Austria took third place, known for its political neutrality, top-tier public transport, and emphasis on sustainability. As safety becomes an increasing priority for global nomads and retirees, the rankings offer a snapshot of the destinations leading the way in providing security and stability. For those considering a move abroad, Iceland’s appeal continues to rise—not just for its natural beauty, but for the peace of mind it offers in an unpredictable world.